Introduction – Soybean Market:

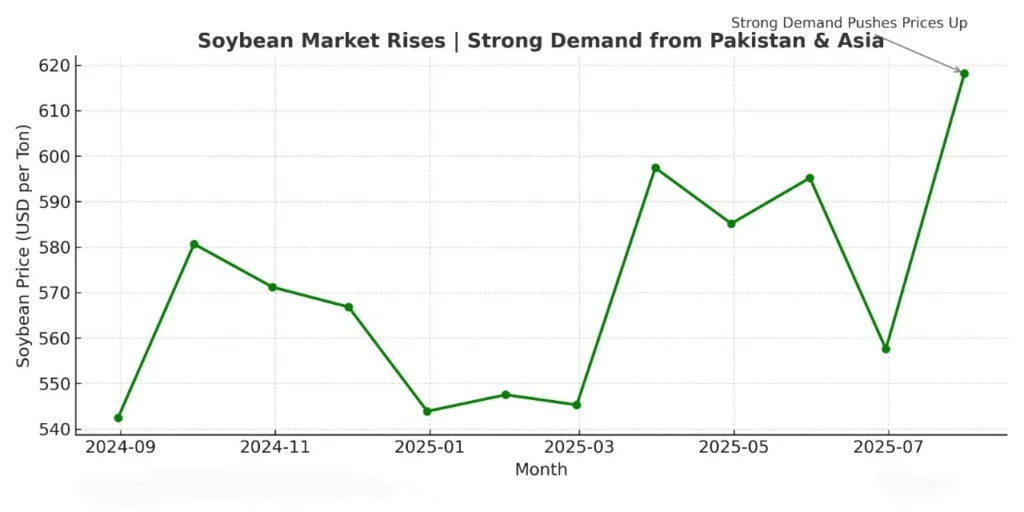

Strong demand from Pakistan and other Asian economies has fueled the soybean market. It’s also witnessing a notable upswing these days. International geopolitical maneuvers are increasingly influencing agricultural commodities especially soybeans. This is not only because of supply and demand fundamentals but also the shift in global trade dynamics. Basically, it’s a differentiated approach toward India and China over Russian energy imports according to recent U.S. trade policy developments. Moreover it also adds a new layer of complexity to commodity flows in the Asian region.

The Demand Surge in Asia:

Across Asia, soybeans are in great demand for both human consumption and animal feed. Key drivers include:

- Growing Middle-Class Consumption: Imports of soybeans for food processing and animal feed are being driven by the increased demand for diets high in protein due to rising earnings in Asian nations.

- Industrial Use: The use of soybeans in the production of processed food ingredients and edible oils is growing, which increases their market share.

- Growth of Pakistan’s Feed Sector: As feed needs rise, Pakistan’s dairy and poultry sectors are growing quickly, driving higher imports of soybeans.

Pakistan’s Role in the Soybean Market:

Pakistan, which mostly sources from the United States, Brazil, and Argentina, has become a reliable customer in the soybean market. Due to the nation’s expanding livestock sector and rising need on imported oilseeds, import trends closely mirror both domestic feed demand and worldwide price trends.

However, supply chain stability is crucial. Any disruption—whether from adverse weather in South America or trade restrictions in North America—can directly impact Pakistan’s feed costs and food inflation rates.

Examine product listings, buy more, and take advantage of the best deals. Visit Zarea right now! It is Pakistan’s biggest business-to-business (B2B) commodities marketplace and is establishing the norm for the country’s future commodity commerce and distribution.

Commodity trade meets geopolitics:

Although harvest yields and weather patterns have historically influenced agricultural commodities, commerce and political decisions are increasingly more important in determining flows.

The United States is a recent example, having slapped secondary tariffs on India for its ongoing purchases of Russian energy while avoiding comparable actions against China. There has been notice of this selective enforcement.

China, which is already the biggest importer of soybeans worldwide, may believe that it has a better negotiating position in trade talks with the United States and other suppliers as a result of this circumstance. A self-assured China may use this to negotiate better conditions for the supply of soybeans, which would have an indirect impact on availability and cost in Pakistan and the larger Asian market.

The Regional Impact on Prices:

Asia’s soybean market is interdependent. Large purchases by China, frequently to restock strategic stockpiles, might reduce supply for other purchasers and raise prices. This implies the following for Pakistan and smaller Asian importers:

- Increased Procurement Costs: In order to prevent price surges in a competitive soybean market, you must have to lock the contracts earlier before it’s too late.

- Transition to Diversified Sourcing: You must consider importing from secondary manufacturers in order to lessen reliance on a single supplier. This may include Paraguay or Ukraine, where this commodity is easily available.

- Growing Dependency on Hedging Tools: You have to manage volatility through futures contracts and other hedging tools in order to grow dependency on it.

How Buyers Can Navigate the Market:

It takes a combination of strategy and agility for procurement executives and commodities merchants in Pakistan and Asia to react to a turbulent soybean market:

- Market Intelligence: Market intelligence is the ongoing monitoring of seasonal forecasts and geopolitical happenings.

- Flexible Sourcing: Keeping up connections with several exporters to prevent bottlenecks is known as flexible sourcing.

- Risk management: Using forward contracts to lock in advantageous pricing while the market is quiet.

Final Thoughts:

A number of factors are affecting the current surge in the soybean market, which may more abrupten the situation. This may include changing global power dynamics and changing dietary preferences. This may also include the calculated actions of key purchasers such as China, which cause this surge. Meanwhile, Pakistan and other Asian nations must comprehend how to be competitive in this market. Moreover, agricultural and geopolitical aspects are involved in this comprehensive initiative.

In the months ahead, purchasers that are able to adjust swiftly will be in the greatest position to ensure consistent, cost-effective supplies, as policy decisions continue to affect global commerce just as much as harvest yields.