Introduction – Russian LNG:

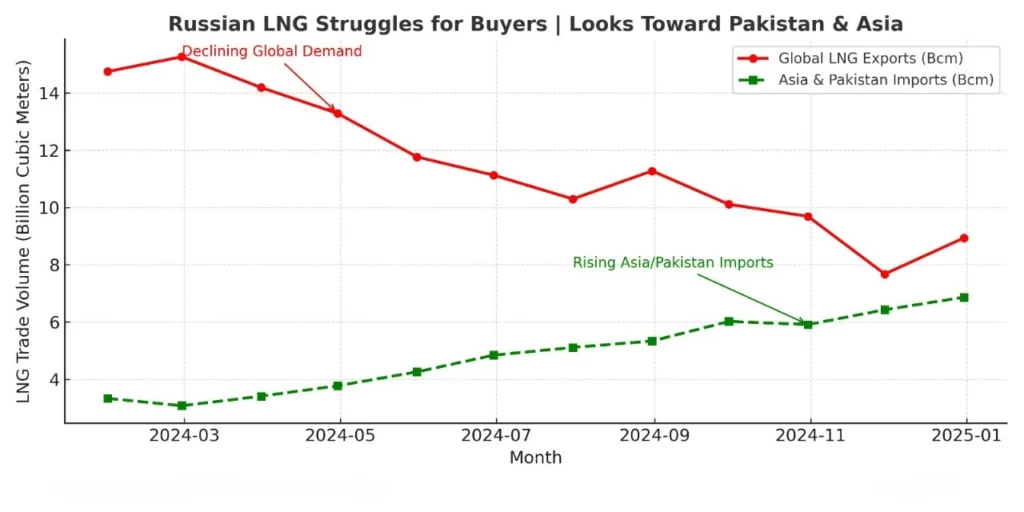

As we know, US sanctions and changing trade dynamics are changing the flow of liquefied natural gas (LNG) these days. Meanwhile, the global energy markets continue to be unstable because of this situation. Moreover, Russian LNG is at the centre of all this change. So it has been excluded from Europe because of geopolitical concerns. That’s why it’s also having trouble in order to find steady consumers all over the world. In order to dump excess cargo and protect its ambitious export goal, Russia has turned its attention to Asia, particularly to nations like Pakistan, as old markets have closed.

To see product listings, order in bulk, and get the best deals, visit Zarea right now! The biggest business-to-business (B2B) commodities marketplace in Pakistan, it is establishing the benchmark for the country’s future commodity commerce and distribution.

Russia’s LNG Expansion and Market Challenges:

Novatek PJSC has spearheaded the Arctic LNG-2 project to its core. Meanwhile Russia has set the lofty goal of tripling its LNG exports by 2030. This facility is essential to Moscow’s long-term energy strategy due to sanctions and operational disruptions. It may also have less access to some conventional Western buyers.

- Although many LNG tankers recently left Arctic LNG-2 for Asia. Yet it’s still unclear if the shipments will find confirmed buyers after all this struggle.

- Although trade has not been completely stopped because of sanctions. Yet they have compelled Russian exporters to look for other partners throughout Asia. This may include China, India and the other developing South Asian markets.

- So the Arctic seasonal weather restrictions have made logistics even more difficult. Even it also limiting the ability to satisfy LNG customer demand.

The geopolitical confluence of global and operational challenges is fragile evidence of Russia’s shift towards Asia.

Asia’s Role – A Balancing Act:

Russian LNG offers both a challenge and an opportunity to Asian economies, especially energy-hungry South Asia.

- China continues to be the biggest possible customer thanks to its strategic connections with Moscow and robust energy needs.

- Although India has already increased its purchases of Russian crude oil, its LNG plan is complicated by pressure from secondary U.S. sanctions.

- Pakistan, which has to diversify its suppliers and lessen its susceptibility to spot market volatility due to frequent energy shortages and high import costs, has become a possible buyer.

However, managing political pressures from across the world while guaranteeing reasonably priced energy access for consumers and businesses is a difficulty for nations like Pakistan.

Pakistan’s Energy Needs and Russian LNG:

Rising electricity consumption, issues with circular debt, and a significant reliance on imported LNG for power generation have all been characteristics of Pakistan’s energy industry. The majority of imports now occur through spot purchases from international providers and long-term agreements with Qatar.

Including Russian LNG in Pakistan’s mix of purchases could:

- Offer affordable substitutes, particularly during the hottest summer months.

- bolster Moscow’s and Islamabad’s bilateral commercial ties.

- Help stabilise Pakistan’s energy and petroleum prices, which have been erratic in recent years.

However, Pakistani procurement officials must strike a balance between their local affordability and their foreign commitments. Reliance on Russian LNG is a politically delicate decision as it may draw criticism from Western allies.

Outlook for Russian LNG in Global Markets:

Although Russian LNG is gradually shifting its focus to Asia, a number of criteria will determine its long-term success:

- Demand will continue to be influenced by geopolitical stability, namely the current tensions surrounding Ukraine and Western sanctions.

- Arctic LNG 2’s infrastructure capabilities and related logistics must function well in spite of seasonal difficulties.

- Buyer appetite — countries like Pakistan, China, and India must weigh affordability against diplomatic risks.

For the time being, Russia’s buyer hunt highlights how the energy landscape is shifting and how Asia, especially South Asia, may become the most important growth market.

Final Thoughts:

The global LNG trade is entering on a new phase. Meanwhile Russian LNG is encountering obstacles in Europe, that’s why it’s shifting its attention toward Asian market. Although this change poses a diplomatic balancing act. Yet it also has a strategic opportunity for Pakistan. Domestic energy demands may be lessened by cheaper LNG availability, but it will be crucial to match purchase with larger overseas commitments.

The way Asia reacts to Russia’s LNG export push, particularly from nations like Pakistan, will decide how effective Moscow’s shift away from Europe actually is.