Introduction – Aluminum Market:

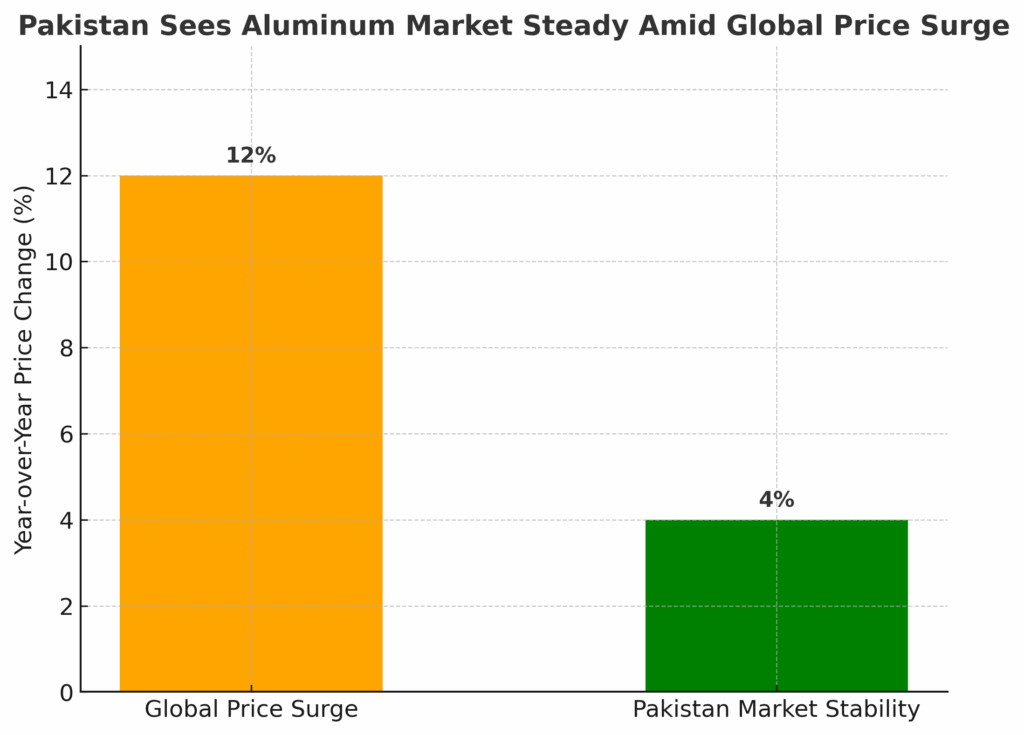

With prices lately reaching their highest level since February, the global aluminum market has been seeing a surge of gains. Even if global variables like the US Federal Reserve’s anticipated interest rate reduction and currency changes have spurred the pace, Pakistan’s aluminium industry has been constant. Nonetheless, supply chains and market dynamics have been impacted by domestic issues such as the recent flood in Pakistan and the growing need for electricity.

It is understood that global factors affect raw materials prices and export competitiveness. This may include the US Federal Reserve’s projected interest rate cuts. Meanwhile it has a big effect on Pakistan’s aluminum sector. On the other hand, currency fluctuations are particularly important from a perspective. Moreover they have the power to change local producers’ profitability and price dynamics. The industry must adjust and plan in response to these influences as well as domestic obstacles. In order to sustain stability and growth these adjustments and plans help the industry in a positive way.

Climate Adaptation Strategy:

Although the aluminium sector helps to minimise carbon emissions and lessen the dependency on fossil fuels. Yet investing in renewable energy sources like solar and wind power is a crucial climate adaptation strategy. However, Pakistan could control climate change and would bring about water shortages. Moreover water management strategies can be put into practice to recycle and preserve water. Lastly, we must implement cutting-edge materials and technologies that improve manufacturing processes. On the other hand energy efficiency might strengthen the sector’s resistance to disruptions through climate change.

Global Trends in the Aluminum Market:

Aluminium prices recently remained mostly stable after an eight-day surge. It’s hovering around $2,700 per tonne on the London Metal Exchange (LME). Meanwhile traders are keeping a careful eye on the Fed’s impending rate-cut decision. Although they are depreciating the currency and improving the growth prospects. Yet they might provide commodities with a new impetus.

Aluminium prices have been supported by supply restrictions as much as monetary policy. A market that is having trouble with insufficient supply is indicated by tight inventories and increases in short-term spreads. Disruptions in Indonesian copper mining have increased general uncertainty in the metals industry, and zinc inventories are near two-year lows.

Visit Zarea right now! Look over our product listings, make your purchase, and begin saving money right now! It is the biggest business-to-business (B2B) commodity marketplace in Pakistan. It also establishes the norm for the country’s future product distribution and commerce.

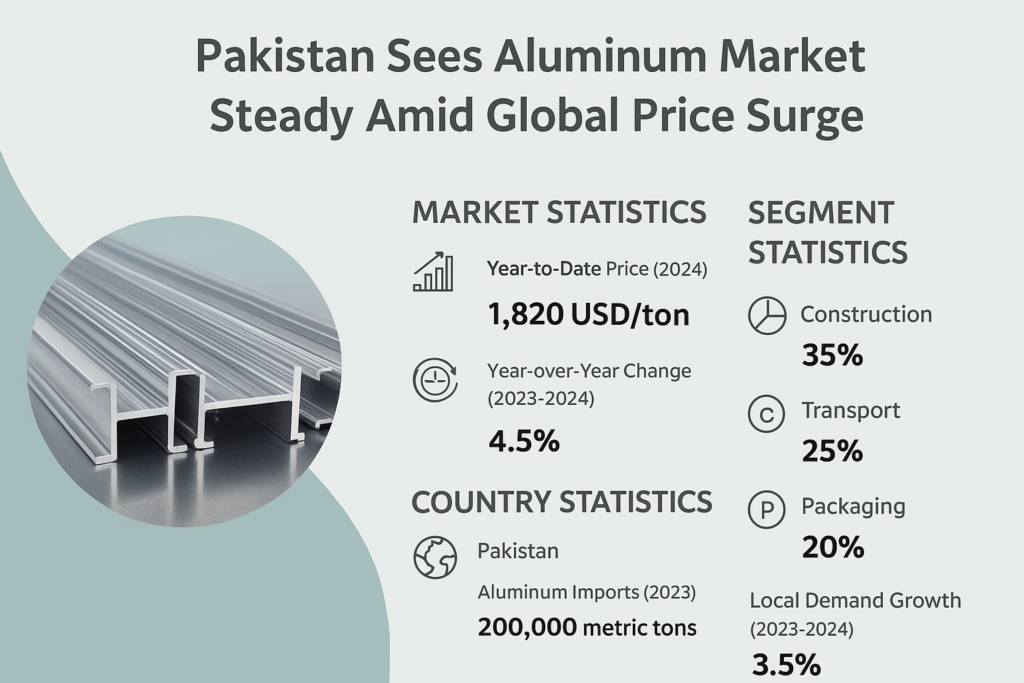

Aluminum in the Pakistani Context:

The demand for aluminium in Pakistan is still stable, especially from the industrial and construction industries. However, supply networks and infrastructure projects are under more strain now than before due to the recent flood in Pakistan. Imports of raw materials and domestic distribution are now experiencing temporary snags due to flood-related damage to electricity and transportation networks.

Although the Pakistani aluminium market has remained relatively stable despite these disturbances. Yet, industrial purchasers are cautious about it. Meanwhile they are managing the effects of regional issues like increased energy costs and logistical delays. On the other hand they are also weighing the procurement choices against worldwide price spikes.

Economic Pressure and Industrial Outlook:

Domestic businesses benefit somewhat from a stable aluminum market. Especially those businesses that are involved in the downstream production of cables, machinery and building materials. Meanwhile, a mix of local difficulties highlight the sector’s fragilities. On the other hand, climate-driven catastrophes, including the Pakistan’s flood and worldwide price hikes also have a huge impact on them.

If aluminium prices continue to rise globally, it would have some impacts. Somehow, Pakistan’s industrial customers may see cost challenges in the medium run. Although the industry’s stability will largely depend on how resilient the local supply chain is. But it also means how supportive the government is of catastrophe recovery.

Final Thoughts:

Although aluminum has taken a jump because of supply worries and monetary changes on world markets. Yet Pakistan’s aluminum industry has been constant for now. However, it reminds us that stability is brittle. It’s because of the consequences of climate-induced disturbances. Just like the floods in Pakistan. Moreover, Pakistan must invest in climate adaptation to ensure its long-term resilience. On the other hand, we should also diversify its sourcing methods, and fortify its infrastructure for long-term stability. These investments will shield its industrial growth from both internal and international price shocks.