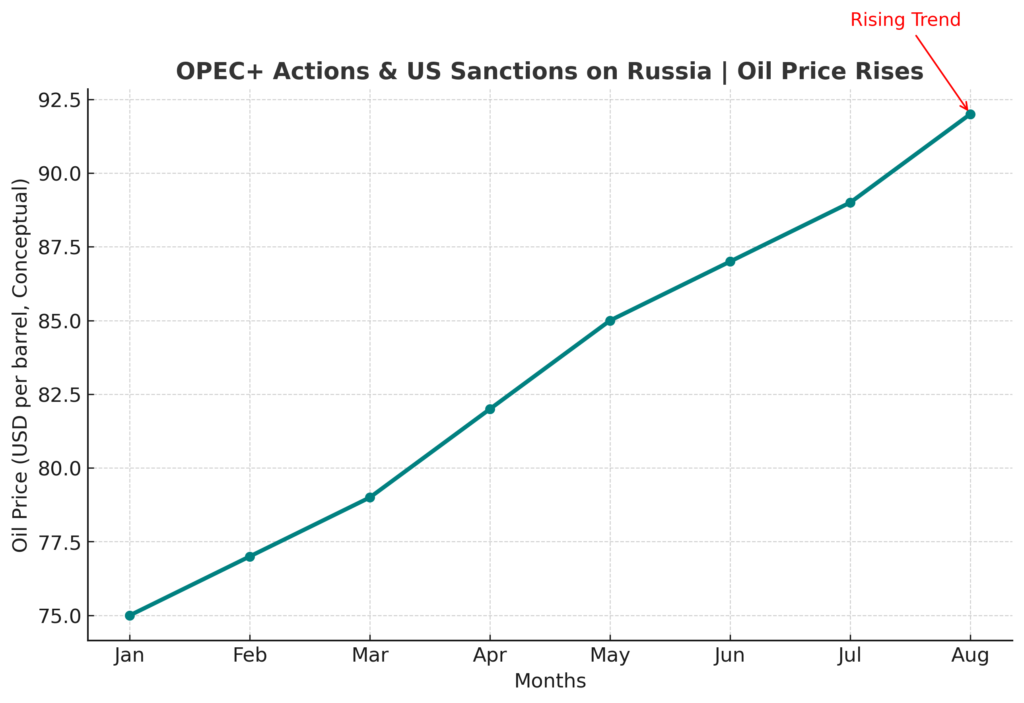

Introduction – Oil Price Rises:

With rising oil prices taking the stage, global energy markets are once again navigating uncertainty. Crude oil benchmarks have slightly increased as OPEC+ gets ready for its next meeting and the US tightens sanctions on Russia. The present prognosis for the oil market is being shaped by the balance between supply discipline, geopolitical concerns, and changing global demand.

OPEC+ Strategy – Balancing Supply and Stability:

It’s understood that OPEC+ has played a significant role in shaping oil market moods in recent years. Meanwhile it implements and carefully controls output to prevent excess crude. Moreover it maintains producer-friendly prices as well. So, market observers anticipate that OPEC+ will maintain supply stability instead of implementing drastic reductions or expansions. As a result the organisation has prepared for its next meeting.

Brent crude has remained stable because of OPEC+’s cautious stance. Meanwhile crude is ranging between $65 and $70 a barrel now a days. However, any departure from this plan may tip the scales. While consuming countries continue to be sensitive to rising import costs, stable prices offer fiscal stability for economies that depend on oil.

Visit Zarea today to see product listings, place large purchases, and receive the best deals! It is the biggest business-to-business (B2B) commodities marketplace in Pakistan. It is also establishing the norm for the country’s future trading and distribution of goods.

US Sanctions on Russia – A Critical Variable:

According to OPEC+ discussions, the significant impact on world oil flows is the result of ongoing U.S. sanctions on Russia. The amid prolonging Ukraine conflict is the main cause of the crude uplift. Thus focusing on Moscow’s oil earnings is leading Washington to apply further pressure on Russia. Meanwhile India is one of the biggest Russian crude consumers. Thats’s why India recently faced pressure to cut back on its purchases of Russian crude. But somehow Prime Minister Narendra Modi reaffirmed trade relations with President Vladimir Putin.

Volatility is caused by the uncertainty surrounding penalties. Tighter enforcement may result in less Russian crude being supplied, which would tighten international markets and drive up prices. On the other hand, Russian barrels may continue to find customers in Asia if sanctions are kept to a minimum, which would reduce price rises.

Why Oil Prices Are Rising Now:

Geopolitical risk concerns and supply management have combined to cause the recent increases in oil prices:

- OPEC+ Discipline: Consistent supply constraints offer a floor on prices and avoid a surplus.

- Sanction Risks: Traders consider in uncertainty when setting pricing due to possible interruptions in Russian shipments.

- Demand Pockets Worldwide The demand for crude oil is still strong in growing Asian markets, notwithstanding slower development in certain economies.

- A further element of supply risk is introduced by geopolitical tensions, when Ukrainian strikes on Russian energy infrastructure occur.

Despite experts’ warnings of possible medium-term oversupply, these factors are maintaining the support of crude prices.

Impact on Asia and Pakistan:

As we know, increases in oil prices have a big economic impact on Asia. Especially on big importers like China, India, and Pakistan always struggle against high crude prices. Although an increase in import bills and depreciating currency reserves rise oil prices. Yet higher domestic gasoline prices are also a consequence which affect oil price rises.

- India: India maintains discounted Russian oil imports. Meanwhile it strikes also a balance between energy security and geopolitical pressure.

- China: China not only reduces volatility, but secures long-term energy contracts accordingly.

- Pakistan: Pakistan is dealing with a precarious balance of payment situation these days. On the other hand, there is a little rise in petroleum prices that exacerbates the budgetary strains and inflationary pressures.

Pakistan is a place where a significant portion of its imports are petroleum goods. That’s why rising oil prices are driving energy and transportation costs up which have a direct affect on consumers and businesses.

Outlook – Rangebound but Fragile:

Crude oil prices may be rangebound for the foreseeable future according to analysts. Meanwhile the key Brent band is between $65 and $70 per barrel. Moreover, uncertainty surrounding U.S. sanctions on Russia limits significant upside. But on the other hand OPEC+’s conservative supply stance prevents extreme drop in crude.

Whether on the long run the current pricing levels are sustainable. As it will depend on the global energy change demand as well. Moreover, investments in renewable energy, slow economic growth and shifting trade patterns are the main causes of these ups and downs.

Final Thoughts:

The recent upward trend in oil price rises how OPEC+ decisions and US sanctions against Russia continue to have a significant impact on world markets. These events highlight the necessity of careful energy management and diversification plans for Asia, including Pakistan.

Oil markets will probably continue to be unpredictable as geopolitical threats change and OPEC+ continues its balancing act, necessitating that companies and politicians alike be ready for a shifting energy scenario.