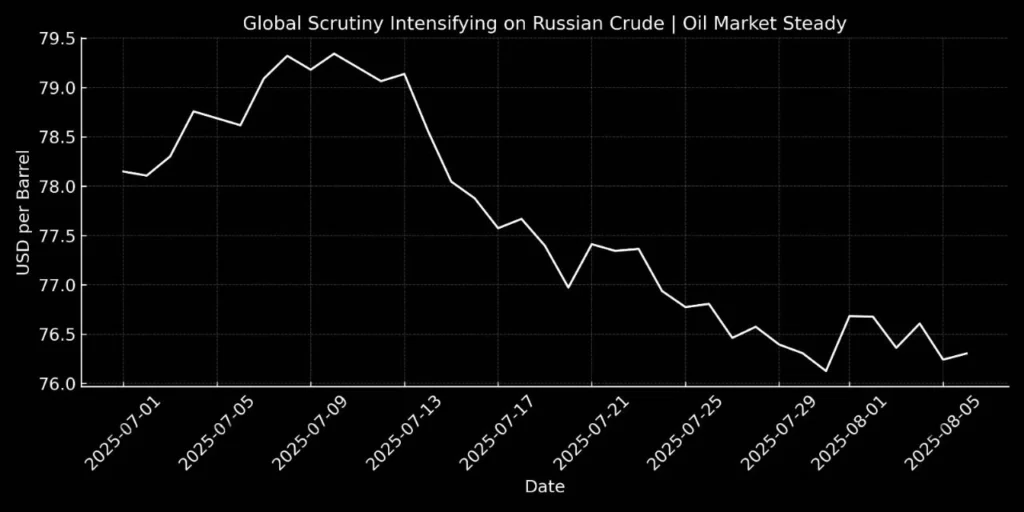

Introduction – Russian Crude & World Oil Market:

In order to stabilize the crude market, the world oil market has been negotiating a precarious equilibrium in recent weeks. These negotiations have taken place between supply stability and geopolitical pressure. Meanwhile, Russia’s oil is at the heart of this dynamic situation. Western countries and international regulators are still closely examining it. Moreover Russian oil supplies continue to flow despite price limitations, sanctions, and diplomatic pressure. That’s why they have continued their supply through more convoluted trading methods.

Russian crude has emerged as a crucial element of energy security. So, this is a changing environment that presents both possibilities and hazards for Asia. Petroleum pricing, import strategies, and long-term energy planning are all having an impact on the Pakistani market.

The Global Scrutiny on Russian Crude:

Western countries have been placing stringent limitations on Russian petroleum imports since the beginning of the Ukrainian conflict in 2022. They have attempted it just to lower Moscow’s energy revenues. Meanwhile Global Scrutiny aims to tighten the flow of funds into Russia’s public coffers of Russian oil exports. That’s why western policies including G7 price limits and restrictions on maritime insurance give a tough time to Russian crude.

Yet, trade patterns have adapted:

- Redirected Flows: Russian oil flows have been redirected from Europe to Asia, especially China, India, and other interested consumers.

- Shadow Fleet: In order to evade detection, Russian barrels are being transported via an expanding network of older, less controlled tankers.

- Discounted Pricing: Price-conscious importers find Russian Urals oil appealing since it is still trading below Brent.

The contradiction is obvious: despite increased monitoring, Russian crude keeps making its way onto the market, temporarily stabilising world oil prices.

Asia’s Position – Strategic Energy Balancing:

Russian crude provides two key advantages to Asian economies: It takes away diversification from Middle Eastern sources and gives price competitiveness to the Asian market. These advantages do, however, come with geopolitical complications:

- India has become one of the biggest consumers, processing Russian oil for both export and local use.

- China has used reduced rates to strengthen long-term supply deals.

- Other countries in Southeast Asia carefully buy in lesser amounts, striking a balance between their diplomatic relations with the West and their economic requirements.

The global oil supply is kept stable by this delicate balancing act, but it also widens the gap between Asian buying practices and Western energy policy.

Impact on Pakistan’s Petroleum Prices:

The exchange rate of the Pakistani rupee and international crude benchmarks have a direct impact on Pakistan’s fuel pricing system. Local markets are nonetheless impacted by regional price changes even though Pakistan has not been a significant direct importer of Russian oil.

Stability of Indirect Prices

Despite geopolitical concerns, the constant flow of Russian petroleum into Asia has prevented a significant spike in oil prices. Pakistan gains indirectly from this as import prices are moderated.

Possibility of Importing Directly

In 2023–2024, Pakistan tried importing smaller volumes of Russian oil, but logistical and processing problems limited scalability. If these problems are fixed, discounted Russian barrels might reduce the country’s oil import expenses.

The factor of currency

The PKR devaluation versus the US dollar has been a significant factor in local fuel and diesel price rises, despite unchanged worldwide pricing. Crude price volatility is still less of a problem than exchange rate fluctuation.

Oil Market Outlook:

Whether the oil market experiences fresh turmoil or stays stable a number of factors will affect it in the future:

- Effectiveness of Sanctions: There may be less Russian crude available if enforcement becomes more stringent. So that situation would raise prices.

- OPEC+ Production Decisions: Market balance will be impacted by any reductions or increases from other producers.

- Asian Demand Trends: Seasonal spikes may drive up costs which could be on the Asian demand trend.

- Geopolitical Risks: Supply interruptions count as geopolitical risks that may result from escalations in the Middle East, Ukraine, or other areas.

This entails maintaining a flexible approach to buying for Pakistan. They are also looking at alternate suppliers and keeping a careful eye on the situation with Russian crude globally.

Zarea’s Perspective on Market Transparency:

Zarea, one of Pakistan’s top B2B commodity marketplaces, provides real-time insights into the oil and petroleum markets and is crucial in matching buyers with trustworthy providers. Having access to precise market data is crucial for traders and procurement officers in order to:

Negotiate better contracts

Time purchases for cost efficiency

Understand global trends influencing local prices

Zarea assists businesses in making well-informed decisions in an unpredictable energy market by monitoring Russian crude shipments, changes in OPEC policy, and currency swings.

Final Thoughts:

The narrative of the Russian crude is far from over. While global monitoring is tightening, supply flows remain constant, offering Asian markets—including Pakistan—a degree of price stability. However, this stability is brittle due to the underlying geopolitical dangers.

Pakistan has two challenges: minimising local vulnerabilities, particularly currency devaluation, and taking advantage of positive global trends when feasible. Agile procurement and market knowledge will be essential for success in this setting.