Introduction – Global Rising Copper Demand:

As copper prices rise due to increased demand for copper throughout Asia, Pakistan’s mining industry is gaining new vigour. Pakistan’s red metal exports are growing in popularity because of their vast applications. Meanwhile, regional economies have developed their manufacturing output and infrastructure according to them. It also provides the nation with a significant source of foreign money.

Although there has been a surge in copper prices. Yet it reflects global demand and market dynamics. Moreover copper’s supply constraints shape trade flows and exchange rate swings. But they are also strengthened for Asian consumption according to its demand.

Global Copper Market – Pushing Toward New Highs:

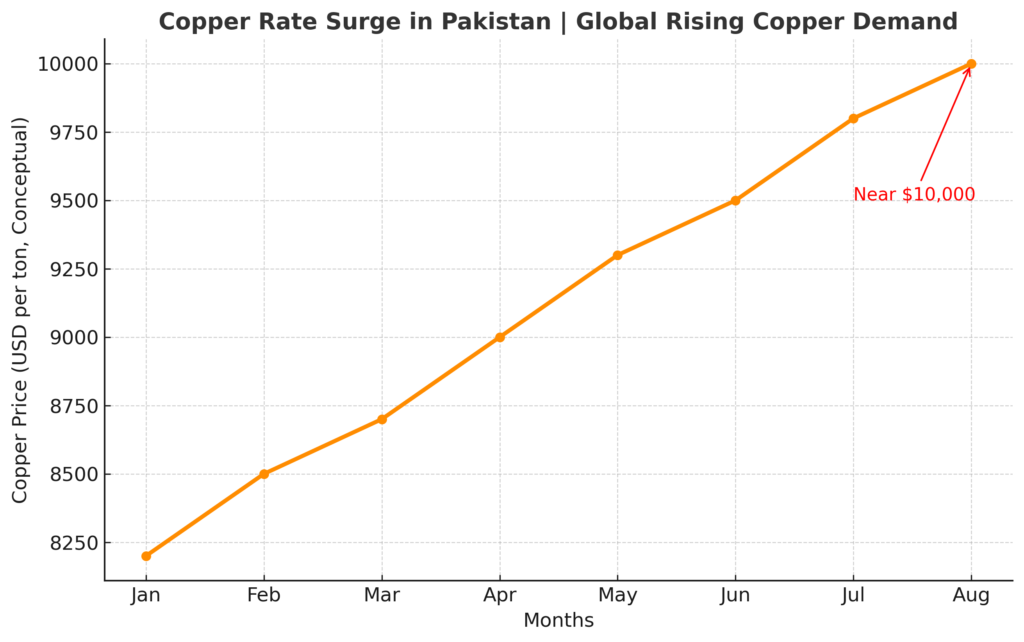

A lower US dollar and consistent industrial activity have helped copper prices on the London Metal Exchange (LME) stay near the $10,000 per tonne barrier. Commodities become more affordable for non-dollar customers when the dollar weakens, which rekindles interest in Asian markets.

This demand surge has been concentrated on China, the greatest copper consumer in the world. According to Zijin Mining Group, China’s apparent copper consumption increased by about 10% in the first half of the year. Asian consumption continues to be a major force behind global pricing stability, despite economists’ warnings of possible deceleration in the second half.

To view product listings, make bulk orders, and get the greatest offers, visit Zarea right now! It is the largest commodities marketplace in Pakistan that connects businesses to businesses (B2B). Additionally, it is setting the standard for the nation’s future commodities distribution and trade.

Pakistan’s Copper Exports – Riding the Wave:

Pakistan is a significant beneficiary of increasing regional copper demand. Now a days Asia has strong copper demand especially from China, South Korea, and Vietnam. On the other hand Pakistan also has high export volumes that have been bolstered in recent months.

This tendency can be attributed to a number of factors:

- Growing Regional Demand: In order to use it in electronics, buildings, and power transmission, Asian economies import more copper according to demand.

- Competitive Price: Pakistan’s copper products remain reasonably priced. Especially when compared to regional producers that toko56 refine copper and concentrate.

- Consistent Export Movements: In order to improve trade facilitation and Letters of Credit (LC) from Chinese banks. Consistent export movements have been stable and made possible transactions and consistent cash inflows.

As a result, Pakistan’s copper export portfolio is quickly emerging as a key component. Moreover it enhances more conventional goods like rice and textiles.

Domestic Implications – Opportunities and Challenges:

Pakistan faces both possibilities and problems as a result of the spike in copper prices and demand:

Prospects

- Important foreign currencies have increased exports. It has also assisted and stabilised Pakistan’s balance of payments.

- Copper’s strong demand encourages new mining explorations. Moreover, foreign investment has abundant copper reserves especially in Balochistan.

Difficulties

- Global copper price volatility can put exporters at risk. It also makes long-term planning challenging situations.

- Regulatory and infrastructure barriers in Pakistan have increased output. In order to satisfy the future demand which is still constrained because of it.

- Careful policy measures are necessary in response to the community. Moreover, environmental concerns about large-scale mining operations are also included in it.

Regional Dynamics – Asia Driving the Market:

Asia’s industrial growth narrative rising copper’s demand which is still driven. Meanwhile copper continues to be essential for power grids, electric cars and consumer electronics. Moreover China’s continuous urbanisation has Southeastern Asia’s fastest growing industrial centre.

Pakistan has a natural edge in meeting this need. This is because of its geographical position in Asia and commercial connections with the world. However, modernising mining operations, making investments in refining capacity, and coordinating trade policies with regional partners will be necessary to maintain export growth.

Final Thoughts:

Pakistan is becoming a more significant participant in the regional metals trade as a result of the present spike in copper demand throughout Asia. Global prices around the $10,000 level provide Pakistan a special chance to broaden its trading base and boost its mineral exports, even if they also represent market instability.

To capitalise on this momentum, Pakistan must develop long-term mining, refining, and trade facilitation capability in addition to using its natural resources. By doing this, the nation may convert temporary advantages into long-term economic stability.