Introduction – Cement Price Trends in Pakistan:

Cement price trends in Pakistan have consistently attracted attention, particularly among individuals in the construction sector. Let’s explore the existing trends, the elements that affect these prices, and what the future could bring.

Recently, Pakistan’s economy encountered several difficulties because of COVID-19, such as market shutdowns and decreased exports. Nevertheless, the construction industry offered a vital uplift, greatly assisting the cement sector. As of 2024, the typical cost of a 50 kg sack of cement in Pakistan currently lies between PKR 1400 and PKR 1500 on average. This range is influenced by the brand, geographical area, and market needs.

Factors Influencing Cement Price Trends in Pakistan:

- Raw Material Costs: The prices of cement are significantly influenced by the cost of raw materials such as limestone, clay, and gypsum. Any alterations in these expenses directly impact the price you pay for cement.

- Energy Costs: Producing cement demands a significant amount of energy. Variations in electricity and fuel costs can greatly affect the price of cement.

- Demand and Supply: Seasonal fluctuations and construction surges can lead to shifts in cement demand. Strong demand usually results in higher prices, whereas weak demand may cause price declines.

- Government Policies: Government policies, such as taxes, import tariffs, and subsidies, play a vital role in shaping cement prices. Modifications in these policies can result in considerable price variations.

Current Market Trends

As per the All-Pakistan Cement Manufacturers Association (APCMA), cement shipments experienced a year-over-year rise of 7% in 2024. This expansion is anticipated to persist as the construction industry grows, especially with current infrastructure initiatives.

Statistics and Market Dynamics

- Market Size: The value of Pakistan’s cement sector exceeds PKR 2.5 billion.

- Manufacturers: The industry includes 24 firms that manufacture approximately 50 million tons of cement each year.

- Exports: Pakistan sells cement to more than 15 nations, with significant markets such as Afghanistan, India, and Sri Lanka.

- Employment: The sector directly employs around 50,000 individuals and numerous others indirectly.

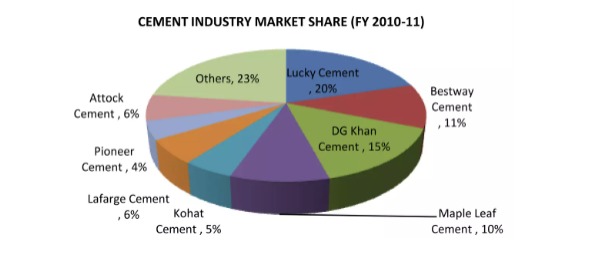

Famous Cement Companies in Pakistan

Several renowned cement companies dominate the market in Pakistan. These include:

- Lucky Cement

- DG Khan Cement

- Bestway Cement

- Maple Leaf Cement

- Fauji Cement

- Flying Cement

These companies play a significant role in shaping the cement price trends in Pakistan today.

Cement Industry Market Structure

Despite the presence of 24 companies in the cement sector, a handful of major players dominate it. A Herfindahl index of 0.10 suggests a market that is competitive and approaching perfect competition. Nonetheless, it is genuinely oligopolistic because the leading companies influence market prices.

Zarea – A Savior Amidst the Crisis:

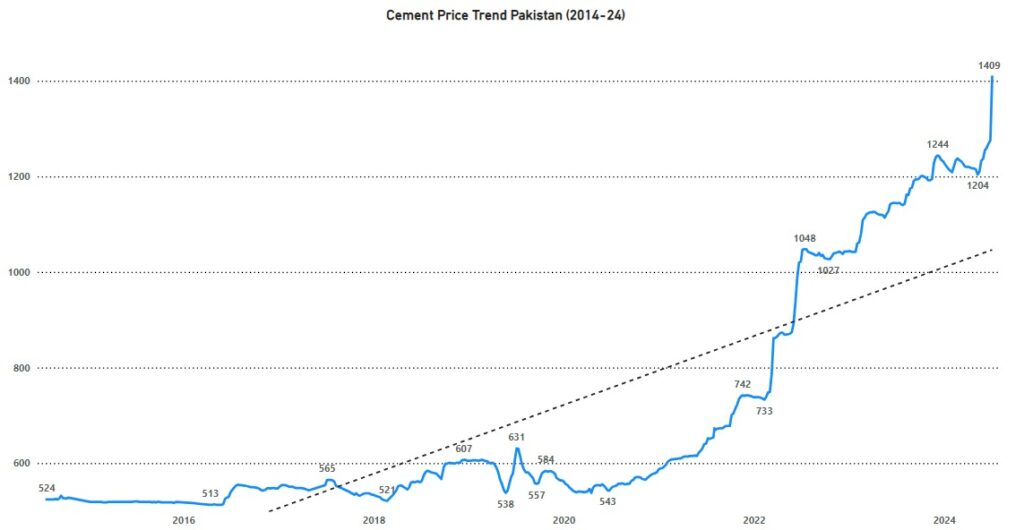

During the last ten years, cement costs in Pakistan have seen significant variations. Beginning at merely 524 PKR in 2014, prices have skyrocketed to an impressive 1409 PKR by 2024. The following graph provides a detailed analysis of these trends over the last ten years insight you can only find on our platform. We’re sharing this information to help you understand market dynamics and make informed decisions. For many, this means that building a home or starting a construction project has become significantly more costly. This challenge was a key reason behind the launch of Zarea. At Zarea, we’re here to guide you through these unpredictable times. As a top digital platform for tangible goods, we offer competitive pricing, dependable supply chains, and crucial market intelligence. Our aim is to guarantee that you receive the utmost value for your construction projects, regardless of market circumstances.

“Build smarter with Zarea where we turn challenges into opportunities.”

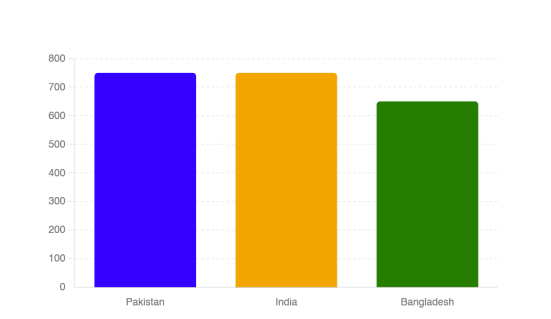

Comparative Analysis with Neighbouring Countries:

In comparison to nearby nations, Pakistan’s cement prices remain notably competitive. For example, a 50 kg sack of cement in India is priced at about INR 350 (roughly PKR 750), whereas in Bangladesh, it costs BDT 500 (around PKR 650). Here’s a graph,

The data shows that Pakistan’s cement prices are competitive compared to its neighbouring countries.

Future Projections of Cement Price Trends

Analysts forecast that cement price trends in Pakistan will stay stable in the near term, with minor hikes anticipated because of increasing energy expenses. Long-term forecasts suggest a steady rise in prices, fueled by ongoing infrastructure expansion and urban growth. In this changing environment, Zarea is your tactical partner. As a B2B digital marketplace and credit provider for B2B, we deliver real-time market analysis, clear pricing details, and adaptable credit solutions. Our platform enables you to stay updated and handle your purchases efficiently, allowing you to navigate price changes and market transitions with assurance. Utilize Zarea’s assets to make informed choices and enhance your business operations in response to evolving circumstances.

Conclusion: What Lies Ahead for the Cement Market?

- The cement industry in Pakistan is a flourishing sector with remarkable growth patterns. Government involvement aided the cement sector in attaining substantial progress in FY2020. In addition to domestic use, Pakistan exports cement to multiple nations. Cement plays a crucial role in infrastructure development and significantly influences the economy because of its intricate supply chain processes.

- Despite the difficulties brought about by COVID-19, the construction industry in Pakistan demonstrated signs of heightened activity and investment, attributed to government incentives and development programs. Consequently, upcoming developmental initiatives indicate a bright outlook for the cement sector in Pakistan.

What do you believe will pose the greatest difficulty for the cement industry in the years ahead?

To gain deeper insights, check out the All-Pakistan Cement Manufacturers Association (APCMA) website. Moreover, keep informed about the current market trends on Business Recorder and Dawn.

References:

- AHL Research. (2021). Pakistan Strategy 2021.

- APCMA. (2021). Historical Analysis of Cement Production Capacity & Despatches (Operational

Units Data). Retrieved from APCMA - Jamal, N. (2020). What is driving cement sales. Retrieved from Dawn

- PACRA. (2021). Cement.

- PES. (2021). Manufacturing and Mining. Retrieved from Finance

- SBP. (2020). The state of Pakistan’s economy.