Introduction – Budget 2025-26 Pakistan:

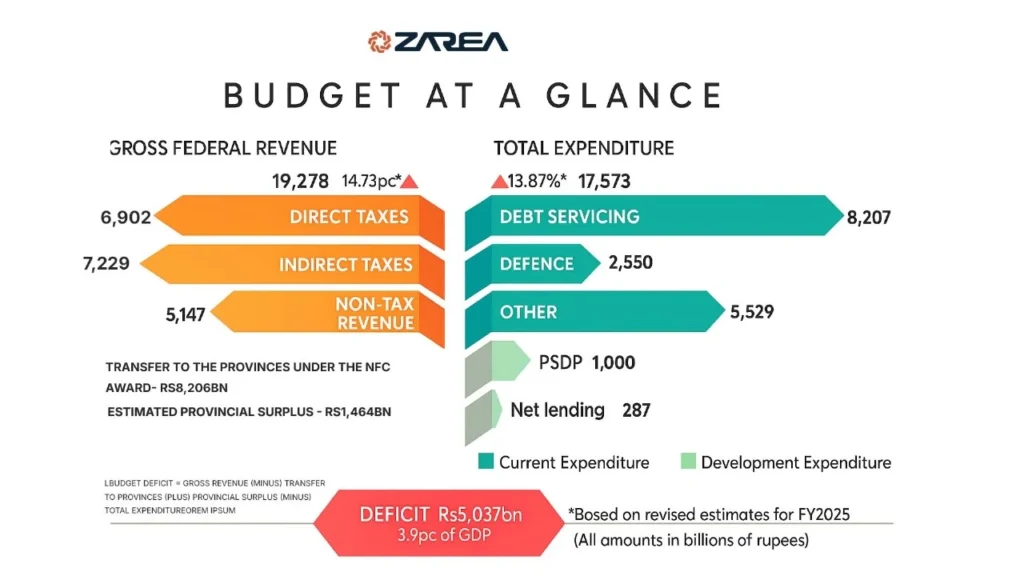

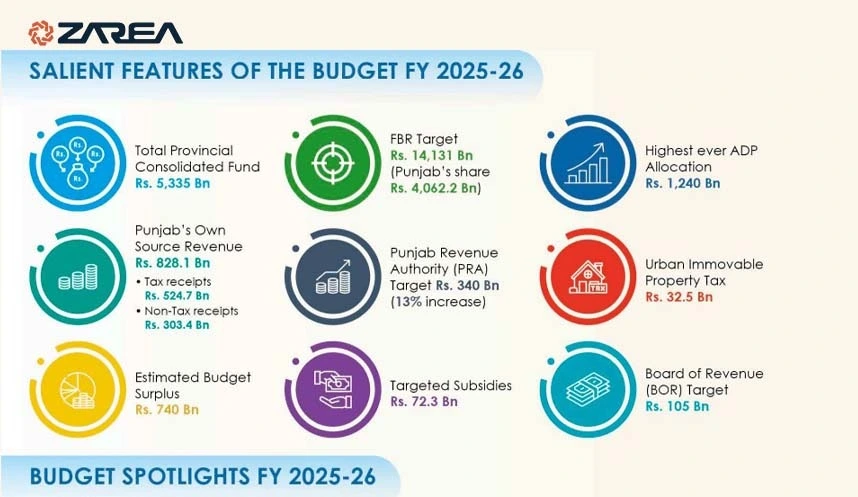

The newly released Budget 2025–26 Pakistan came with big promises and big plans. The government pledged to collect Rs 14.3 trillion in revenue, increase GDP by 4.2%, and reduce the fiscal deficit to 3.9% of GDP. Although these figures show growth, a closer examination shows a different picture, one in which the budget seems to favor a select few in power while ignoring the vast majority who make up the foundation of the nation.

The message is plain for both overworked taxpayers and neglected farmers: Pakistan’s most recent budget shows more of the same: wasted opportunities for structural transformation, elite preservation, and short-term remedies.

A Budget Framed Around the Powerful:

Although the finance minister spoke of reforms and relief, the numbers tell a different story. A token tax relief for salaried workers amounts to just a few hundred rupees per month. On the other hand, tax breaks worth Rs 5.84 trillion still help powerful interest groups like landowners, real estate developers, and people who bring in luxury goods.

This huge amount is more than the combined budgets for health and education. These kinds of priorities make people very worried about fairness and foresight in a country that is dealing with debt, unemployment, and a decline in human development.

Agriculture Left Behind Again:

Despite employing close to 40% of Pakistan’s workforce, the agricultural sector only makes up 1% of the country’s tax revenue. In spite of this, the industry is nonetheless underfunded and badly run. Due to bureaucratic red tape and elite capture, small farmers—who require the most assistance—rarely benefit from the Rs 2,066 billion in enhanced agricultural loans that the government announced.

The failure of wheat procurement policy earlier this year, where excessive imports undercut local farmers, has already left many in rural areas devastated. Cotton production plummeted over 30% last year, but instead of offering meaningful investment in modern tools or cold-chain logistics, the budget offers only vague promises.

In a truly development-focused budget 2025-26 Pakistan, agriculture would have been a top priority.

Energy Crisis Ignored, Solar Discouraged:

Pakistan’s energy sector is in danger of collapsing due to its Rs 2.4 trillion circular debt. Daily living and industrial productivity are still disrupted by load-shedding. However, there is no clear way forward in the budget. Instead, the burden is increased by charging an 18% sales tax on imported solar panels and reducing net-metering rates from Rs 27 to Rs 10 per unit.

This discourages the adoption of renewable energy and draws attention to policy contradictions, which turns off potential investors. The budget’s silence on grid upgrading and transmission efficiency is concerning for a nation that is experiencing energy instability.

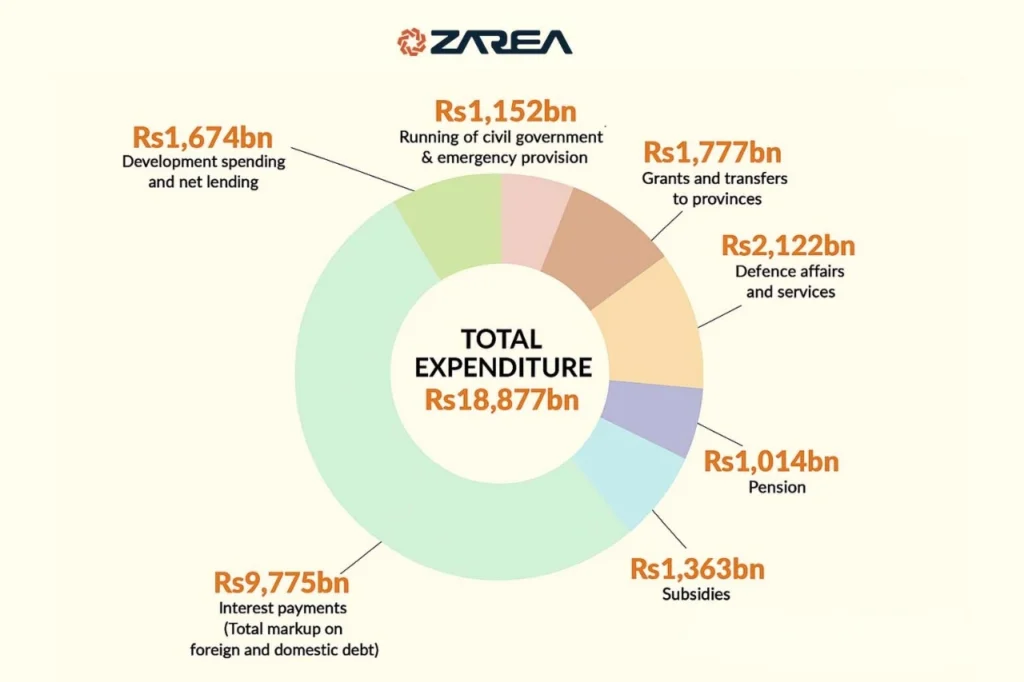

Heavy Defence Spending, Light on Development:

Including pensions and other expenses, defence spending has risen by 14% to Rs 3.97 trillion. Despite the importance of national security, development is being sacrificed in the process. With 118 projects abandoned, the Public Sector Development Programme (PSDP) saw savings totaling Rs 1,000 billion.

Pakistan would benefit more from long-term investments in cyber security, education, and innovation in a time when contemporary warfare depends more on intelligence and technology than on conventional infantry.

Missed Opportunity for Tax Reform:

The tax system in Pakistan is still unduly complicated, unfair, and deterrent to business owners. The budget adds new taxes on digital transactions in place of significant changes, which may push tiny internet enterprises back into the black market.

The government had promised to digitize the Federal Board of Revenue (FBR), but results remain underwhelming. Revenue leakage continues, and the tax-to-GDP ratio lingers around 10.6%, far below regional benchmarks. In comparison, India’s tax-to-GDP ratio is 18.5%, with provinces having more fiscal autonomy to address local needs.

A flat 20% corporate tax, simplified income slabs, and elimination of preferential exemptions could broaden the tax net and enhance compliance—but such reforms remain absent from the budget 2025-26 Pakistan.

Burdened Provinces, Centralised Control:

Only 1% of GDP is raised by provinces on their own; they still mostly rely on federal contributions under the NFC Award. Provincial capacity to invest in local health, education, and infrastructure is hampered by this monetary centralization. The budget reinforces top-down authority instead of strengthening local governance under the 18th Amendment, which does little to rectify this imbalance.

To see product listings, current prices, and to place your bulk purchase right now, visit Zarea!

Mounting Debt, Little Relief:

By March 2025, Pakistan’s state debt had grown to Rs 67.8 trillion, or 74.1% of GDP. More than 80% of net federal revenue is used for interest payments alone, leaving little for growth. Despite the announcement of a Rs 850 billion refinance savings and a Rs 1,000 billion debt repurchase, the budget does not include a comprehensive debt-reduction plan.

The debt trap will only become worse if fundamental debt drivers like ineffective subsidies and unfocused development investment are not addressed.

Digital Taxes Risk Killing E-Commerce Growth:

The new digital-transactions levy—ranging from 1% to 5% depending on transaction size and platform—is framed as a way to tax the growing digital economy. However, it could have the opposite effect. Small e-commerce vendors and gig workers, already working on thin margins, may shift back to cash-based transactions to avoid compliance complexities.

This levy reflects the government’s preference for new taxes over simplification, perpetuating informality and stifling innovation in a sector with tremendous export potential.

What Needed to Be Done?

Pakistan’s 2025–2026 budget would have been really progressive if it had included:

- Reduced compliance costs and a more straightforward tax code with fewer exemptions

- Rewards for exporters, startups, and SMEs

- focused assistance for agriculture, with a focus on small farmers

- Energy grid modernization and stable renewable energy policy

- Increased provincial independence in development and taxes

- Debt reduction strategy grounded in revenue reform and spending efficiency

- Boosted funding for education, health, and digital infrastructure

Final Thoughts:

The economy demands stability at a critical time when the budget for 2025-26 Pakistan arrives. For the citizens are hungry for big change and businesses seek clarity on this sensitive situation. However, this budget prioritizes elite appeasement like many others before it and short-term political benefits above long-term national reform.

Every budget that passes will continue to favor a select few while making life more difficult for others until Pakistan makes a commitment to significant changes that put productivity, equity, and decentralized development first.

FAQ’s:

How much pension increase in budget 2025-26?

A 5% increase in pensions for retired officials includes in the provincial budget for fiscal year 2025–2026. The Punjab Assembly also approved a 10% increase in salaries for government workers on Monday.

How much is the Pakistan budget in 2025?

Although the government’s federal budget for 2025-2026 is down 6.7% as compared to 2024–2025 (about USD $62.45 billion). Yet defense now accounts for a larger portion of the budget than it did last year.

How much salary increase in budget 2025?

It has been suggested that the Employees’ Old-Age Benefits Institution pension be doubled from its current level of Rs11,500 to Rs23,000, and that the minimum monthly wage be raised from the current Rs37,000 to Rs50,000.

What is the reserve money of Pakistan in 2025?

| Last | Previous | Unit |

|---|---|---|

| 15,598.8 Jan 2025 | 15,927.4 Dec 2024 | USD mn |

What is the annual salary increment in Pakistan?

Government Sector Annual Increment Regulations:

Date of Increment: On December 1st of each year, government workers normally receive their yearly raise. Increment Amount: BPS-01 to BPS-16 employees typically see pay increases of about 25%. The increments for BPS-17 to BPS-22 are about 20%.