Introduction – Sarwa Islamic Savings Account:

In recent years, Islamic banking has become one of the fastest growing sectors in Pakistan. Islamic banking has also played a vital role in the financial sector. Meanwhile many Pakistanis are increasingly interested in Islamic savings products. So, the main desires behind them are ethical investment opportunities and the increased awareness of Shariah-compliant finance. The Sarwa Islamic Savings Account is a dependable and transparent choice for those who are in search of financial stability and halal profit.

This article offers a comprehensive examination of the Sarwa Islamic Savings Account, including its profit rates, Shariah principles, and the reasons why it has become the preferred option for investors throughout Pakistan.

Currently, you can visit Zarea to examine the biomass products and construction materials, compare prices, and make a wholesale purchase.

Understanding the Sarwa Islamic Savings Account:

The Central Directorate of National Savings (CDNS) offers the Sarwa Islamic Savings Account. Basically it’s a Shariah-compliant savings option under Pakistan’s National Savings Scheme (NSS).

In simple words the Sarwa Islamic account functions according to Islamic financial principles. Meanwhile, this account ensures that individuals obtain profits solely from halal (permissible) sources. On the other hand, traditional accounts pay interest (riba), which Islam severely forbids.

Through this account, Pakistani nationals and residents abroad can earn competitive returns based on Islamic profit-sharing principles while saving money in an ethical manner.

How the Sarwa Islamic Savings Account Works:

The Sarwa Islamic Savings Account (SISA) is based on the concept of Mudarabah, a partnership model in Islamic finance. In this structure:

- The investor (Rab-ul-Maal) provides funds—these are the depositors.

- The manager (Mudarib), who in this case is the government or bank, invests these money in Shariah-compliant companies.

- Profits from these investments are split between the two parties based on a predetermined profit-sharing ratio.

- Investors bear any losses unless they are caused by the Mudarib’s carelessness or malfeasance.

This ensures a transparent and risk-sharing arrangement, distinguishing the Sarwa Islamic account from conventional interest-based systems.

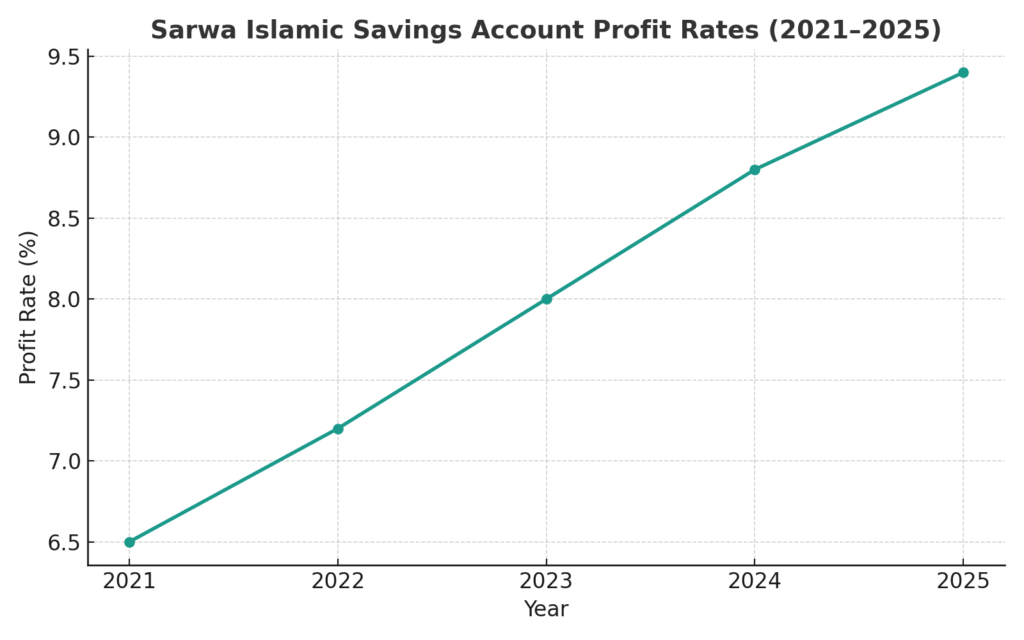

Profit Rates on Sarwa Islamic Savings Account (2025 Update):

As of 2025, they revised the profit rate on the Sarwa Islamic Savings Account following broader changes in the National Savings profit rates.

The most recent adjustment, released by the Central Directorate of National Savings (CDNS), decreased rates across numerous programs in response to a drop in national inflation trends and monetary adjustments by the State Bank of Pakistan.

The Sarwa Islamic Savings Account now offers a profit rate of around 9.75%, down from 10.34% previously. This is a 59 basis point (bps) cut, one of the most significant changes among Islamic savings vehicles.

Despite this reduction, the Sarwa account continues to offer competitive and stable returns compared to other Shariah-compliant saving options in the market.

Why the Rate Change?

Macroeconomic factors link profit rates on National Savings products—including Sarwa Islamic, Behbood, and Regular Income Certificates:

- Inflation Trends: A decline in inflation typically prompts lower profit adjustments.

- Monetary Policy: The State Bank’s decisions on benchmark interest rates influence overall financial yields.

- Fiscal Management: The government’s efforts to manage debt and liquidity often affect the profitability of public savings schemes.

In 2025, as inflation eased and the SBP aimed to balance liquidity with growth, CDNS revised profit rates across multiple schemes—including the Sarwa Islamic Savings Account—to align with current economic realities.

Key Features of the Sarwa Islamic Savings Account:

The Sarwa Islamic Savings Account is intended to appeal to both conservative and faith-conscious investors. Its key features are:

- Minimum Investment: Minimum investment is Rs. 100 or more, making it available to the entire population.

- Profit Payout: Profits are paid out regularly, giving a constant income.

- Zakat Deduction: Many depositors seeking religious compliance prefer to invest in the Sarwa Islamic Savings Account, which is free from the Zakat deduction.

- Shariah supervision: The plan is overseen by a Shariah Supervisory Board, which ensures that all investments adhere closely to Islamic financial rules.

- Availability: Open to Pakistani citizens, both local and overseas, as well as organizations seeking halal investment opportunities.

Comparison: Sarwa Islamic vs. Conventional Savings Accounts:

| Feature | Sarwa Islamic Savings Account | Conventional Savings Account |

|---|---|---|

| Basis of Earnings | Profit from halal investments (Mudarabah) | Fixed interest (riba) |

| Risk Sharing | Shared between depositor and bank | None – bank guarantees interest |

| Profit Certainty | Variable, based on performance | Fixed, pre-decided interest |

| Shariah Compliance | Fully compliant | Not compliant |

| Zakat Deduction | Exempt | Typically applicable |

| Transparency | Regular Shariah audits | No Shariah oversight |

The Sarwa Islamic Savings Account’s emphasis on transparency, risk-sharing, and ethical investment gives it a unique edge for those seeking spiritually and financially secure options.

Halal Profit Explained:

In Islamic finance, profit differs fundamentally from interest. Participants earn profit through engaging in real economic activity—trade, investment, or leasing—while lenders receive interest as a predetermined, risk-free gain without productive contribution.

The Sarwa Islamic Savings Account invests in real, Shariah-compliant economic ventures. These can include government infrastructure projects, Islamic sukuk (bonds), and halal industries such as agriculture, manufacturing, and trade.

According to these initiatives, each month National Savings makes profits and allocates to depositors in accordance with the agreed profit-sharing ratio. They also guarantee that all returns are obtained legally.

Who Should Choose the Sarwa Islamic Savings Account?

The Sarwa Islamic Savings Account is suitable for:

- Faith-conscious investors who wish to guarantee that their savings are in line with Islamic teachings.

- Senior citizens looking for consistent halal income without exposure to market volatility.

- Families and small investors seeking safe, government-backed savings plans.

- Overseas Pakistanis (NRPs) want to invest in reputable and ethical savings products in Pakistan.

With government oversight and Shariah compliance, this account offers the dual benefit of security and spirituality.

How to Open a Sarwa Islamic Savings Account:

Opening the account is a straightforward process available through National Savings Centers (NSCs) and authorized branches.

Documents Required:

- CNIC (Computerized National Identity Card)

- Recent photographs

- Proof of address

- Completed account opening form

Once processed, profit payments start accruing from the date of issuance, and customers can monitor their returns through periodic account statements.

The Broader Role of Islamic Savings in Pakistan’s Economy:

The Sarwa Islamic Savings Account is more than simply a personal investing instrument; it also contributes significantly to the development of Pakistan’s Islamic financial ecosystem.

These accounts help by channelling savings into profitable, halal companies:

- Reduce dependence on interest-bearing borrowing.

- Encourage financial inclusion for low-income people.

- Encourage national growth via ethical investment.

With Islamic banking developing at a pace of more than 20% per year, products like the Sarwa Islamic Savings Account are bridging the gap between faith and contemporary financial requirements.

Final Thoughts:

The Sarwa Islamic Savings Account is an important step towards a brighter future. Further, it’s establishing a fair, transparent and Shariah-compliant financial system in Pakistan. On the other hand, profit rates have consecutively updated to reflect macroeconomic realities. These rates remain competitive while guaranteeing that every rupee made is halal.

For those looking to blend financial prosperity with spiritual ideals, the Sarwa account is a dependable and ethical option. As Pakistan’s Islamic banking environment expands, financial institutions anticipate that such savings products will become increasingly popular, allowing individuals to save with confidence, faith, and purpose.