Introduction – Pakistani RICS March 2025:

The Central Directorate of National Savings (CDNS), sometimes referred to as Qaumi Bachat, changed the profit rates on Regular Income Certificates, Pakistani RICs March 2025, bringing about yet another big shift in Pakistan’s financial scene. Since their introduction in 1993, these certificates have been a mainstay of Pakistani savings products. They are intended to give investors—especially middle-class households, pensioners, and those looking for steady income streams—consistent monthly returns.

Profit rates have been lowered in the most recent adjustment, which went into effect in March 2025. This change is mostly attributable to the nation’s lowering inflation rate. The action has direct repercussions for investors and savers who depend on these certificates, even if it also represents larger macroeconomic stabilisation initiatives.

The history of RICs, the details of the updated rates, the effects on investors, and the overall economic environment around Pakistani RICs in March 2025 will all be covered in greater detail in this article.

Background – What Are Regular Income Certificates?

In 1993, the Pakistani government launched Regular Income Certificates (RICs), a fixed-income savings option. The objective was simple: to give individuals a state-backed monthly income choice that was safe and reliable.

- Maturity Period: RICs have a five-year term.

- Denominations: They provide flexibility for both small and big savings, coming in multiples of Rs. 50,000, Rs. 100,000, Rs. 500,000, Rs. 1,000,000, Rs. 5,000,000, and Rs. 10,000,000.

- Profit Payout: This process begins with the date of the issue. So, investors get a monthly profit from it. Meanwhile it also directly meet families’ liquidity needs.

- Target Audience: Most RICS investors are seniors, widows, retirees and salaried people. Moreover, most families rely on reliable income sources like CDNS.

RICS has grown and become a reliable financial instrument in Pakistan over the years. Because of the government’s support and steady returns to customers so far.

To see the product listings, order in quantity, and get the best deal available. Visit Zarea right now! the biggest business-to-business (B2B) commodity marketplace in Pakistan, establishing the benchmark for the country’s future commodity commerce and distribution.

The Latest Revision – Profit Rates in March 2025:

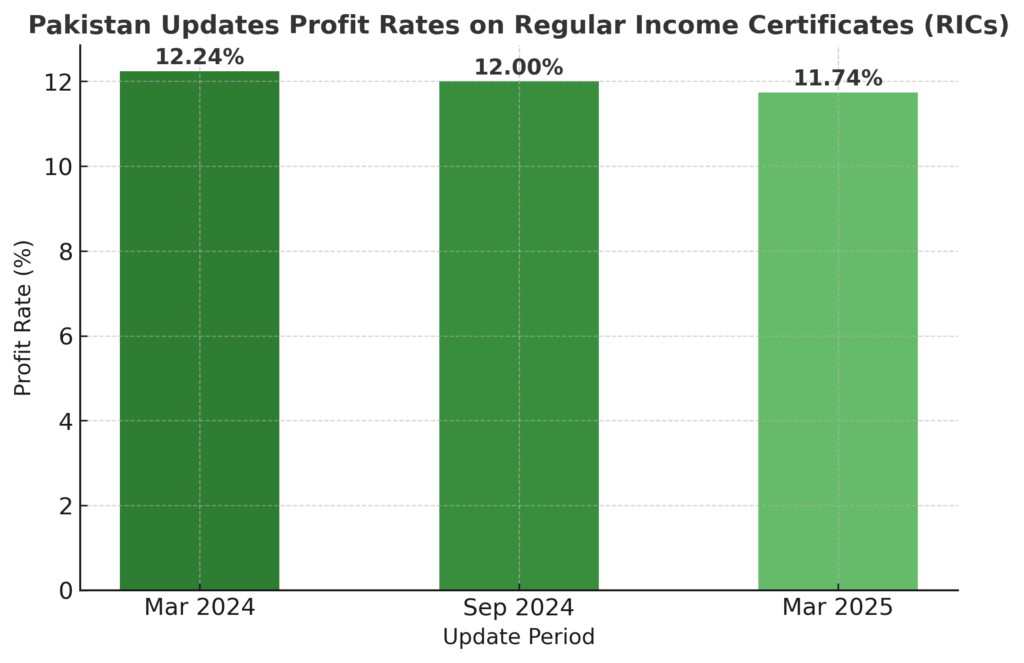

Due to the quick changes in economic data, the CDNS announced the third modification of profit rates in less than three months as of March 2025. The following are the most recent rates:

- Profit Rate: The yearly profit rate is set at 11.74%.

- Example of Monthly Payout: Under the prior rate, investors would have received Rs. 990 each month on an investment of Rs. 100,000, but now they would receive Rs. 979.

Although these adjustments can seem insignificant on an individual basis. Yet the cumulative effect is significant for big investors and households who rely heavily on these returns.

Why Were the Rates Revised?

The lower revision has been largely ascribed by the government to Pakistan’s falling inflation patterns. A few crucial elements stand out:

Reducing Inflation

- Early in 2025, inflation, which had been in the double digits in recent years, started to show indications of slowing down.

- The government can lower the interest on savings vehicles while maintaining their competitiveness as inflation declines.

Financial Aspects to Take into Account

- High national savings plan profit margins raise the cost of borrowing for the government.

- The government hopes to control its budget deficit while providing investors with a sustainable return by reducing interest rates.

Alignment of Monetary Policy

- Additionally, the State Bank of Pakistan (SBP) has been relaxing its position on policy, demonstrating its belief that inflation would continue to decline.

- Decisions about SBP frequently follow changes in profit rates on RICs.

Pakistani RICS March 2025 – Implications for Investors:

Investors are impacted by profit rate revisions in a number of ways:

Lower Monthly Income

The decreased payouts result in lower monthly cash flow for those who rely on RICs as their main source of income, particularly retirees.

Change in Investing Practices

To make up for the decreased income, some investors could look into alternate savings or investing options like mutual funds, government bonds, or even stocks.

Self-assurance in stability

Even while the decline in returns could appear unfavourable, many regard it as an indication that macroeconomic circumstances are stabilising, particularly if inflation keeps down. Higher but unpredictable yields may not always be better than a lower but steady return.

Zakat Deduction Exemption

Because RIC investments are not subject to the Zakat deduction, the net return is nevertheless comparatively appealing to investors who are sensitive to religious beliefs.

Broader Economic Context:

It is impossible to consider the March 2025 modification of Pakistan’s RICs in a vacuum. It is part of a broader story about stabilisation and economic management.

- Macroeconomic Stability: In the face of mounting foreign commitments and circular debt in the energy industry, Pakistan has been attempting to regain budgetary restraint.

- Energy Sector Link: The government’s commitment to addressing long-standing problems is demonstrated by the recent historic settlement of Rs. 1,225 billion in circular debt. Sustaining investor trust in national savings vehicles requires a steady budgetary trajectory.

- Global Trends: Governments throughout the world have more leeway to reduce returns on savings products as a result of falling commodity prices and lessening inflationary pressures. Pakistan is not an exception.

Comparison with Other Savings Instruments:

The key query for savers is: In March 2025, how do RICs stack up against alternative options?

- Special Savings Certificates (SSC): Provide attractive rates, however they are less appropriate for people who require monthly liquidity due to their biannual profit distributions.

- Defense Savings Certificates (DSC): Higher long-term earnings are offered by Defence Savings Certificates (DSC), although they need ten years of fund locking.

- Bank Deposits: Without CDNS’s government guarantee, commercial banks may provide rates that are similar or somewhat lower.

People who value monthly income and government-backed security continue to find RICs appealing.

Challenges Ahead:

There are still certain issues in spite of the government’s efforts:

Juggling the Needs of Investors with the Financial Burden

While higher rates put a pressure on government resources, excessively aggressive rate reductions may turn away savers.

The volatility of inflation

The existing rates could lose their appeal in real terms if inflation increases once again as a result of outside shocks (such as changes in the supply chain or spikes in the price of oil).

Knowledge of finance

Many investors depend almost entirely on RICs and are unaware of alternate savings options. Diversifying risk requires education.

Final Thoughts:

Both the potential and difficulties of administering national savings instruments in a changing economic context are shown by the March 2025 modification of profit rates on Pakistani RICs. Investors’ monthly income may be marginally reduced by the new rate of 11.74%, but it also represents a larger trend of declining inflation and enhancing fiscal stability.

Government-backed choice for Pakistani investors seeking consistent monthly returns. That’s why RICS remains a safe choice in Pakistan. Especially when you talk about pensioners and households who rely on reliable cash flows. The ruling also emphasises how crucial it is to diversify your investments. However, when you want to maintain financial stability in the face of shifting market conditions.

RICs will continue to play a crucial role in connecting family savings. It’s because Pakistan is attempting to stabilise its economy and meet the demands of national development. The March 2025 update reminds us that savers and the government need to adjust together in a world of changing economic realities.

FAQ’s:

What is the profit rate of Bahbood certificate in 2025?

As of July 28, 2025, the Behbood Savings Certificate (BSC) profit rate has decreased by 24 basis points to 12.96%. For every Rs. 100,000 invested, this yields a profit of about Rs. 1,080 every month. The BSC offers tax-free monthly profit payments that are paid to a connected savings account, making it ideal for widows, the elderly, and those with disabilities.

What is the period of regular income certificate?

5 for a predetermined duration of 5 years. A properly completed and signed profit coupon admitting receipt of the profit amount must be presented to the issuing officer by the certificate holder claiming monthly profit.

What is the tax rate for national savings certificate?

Filers: Individuals listed on the Active Tax Payer List (ATL). The withholding tax rate is 15% of the yield or profit, regardless of the investment date or amount.

How to get a low income certificate from FBR?

A family or person must present documentation of their financial situation and income in order to receive a low income certificate from FBR. Typically, this entails filing an income tax return with the FBR and enrolling for income tax.

Which bank gives the highest interest rate in Pakistan?

Interest rates fluctuate and differ by product, term, and balance tier, thus no one bank can be said to give the best interest rate all the time. While some other banks may provide competitive rates on their digital or high-yield savings accounts, as well as even greater yields on fixed deposits or term certificates, Bank Alfalah’s Alfa Savings Account and Bank AL Habib’s Freelancer Savings Account, for instance, provide rates of about 9.50% APR.