Introduction – Corn Rate Fall:

Record harvest predictions in the United States have caused corn prices to drop precipitously. Meanwhile this prediction is also causing major changes in the global grain market. Throughout Asia and Pakistan corn rates greatly influence the prices of food, feed and industrial inputs with repercussions. Moreover this trend is having a deep impact on global supply chains these days. Although the decreased prices of livestock producers and poultry are benefiting somewhat. Yet farmers and suppliers in the area face additional difficulties as a result of the price fall.

Record U.S. Harvest Sparks Global Price Pressure:

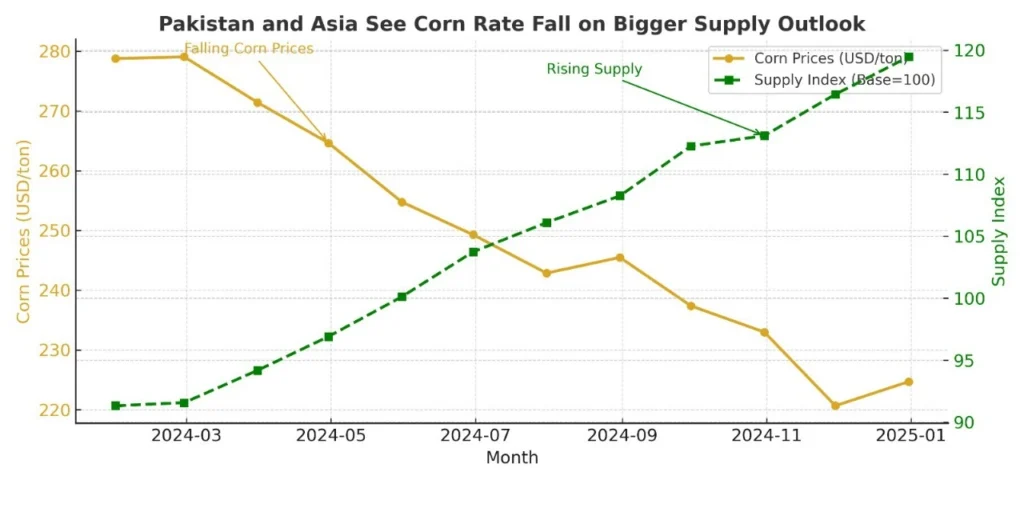

With yields of 188.8 bushels per acre, the U.S. Department of Agriculture (USDA) has updated its forecasts for maize output to a record-breaking 16.742 billion bushels. This is one of the biggest harvests in American history because to favourable weather, increased planting, and copious amounts of water.

Consequently, maize futures fell roughly 4% to $3.92 per bushel, the lowest price in nearly a year. International prices have been under downward pressure due to the negative outlook, which has resulted in lower import benchmarks for Asian purchasers.

Get the greatest rates, view product listings, and place bulk orders by visiting Zarea right now! Setting the standard for future commodity distribution and trade in Pakistan, it is the largest business-to-business (B2B) commodities marketplace in the nation.

Impact on Asian Markets of Corn Rate drops:

A softer maize rate offers some cost relief in Asia, where maize is an essential feed grain for the livestock, poultry, and aquaculture sectors. It is anticipated that nations like China, Vietnam, and Pakistan will gain from feed mills and food processors securing supply at more affordable prices.

- Although its purchasing approach has become more varied, China, the largest importer of maize in the world, still uses imports to make up for domestic shortages.

- The feed and aquaculture industries in Vietnam and Southeast Asia are seeing high demand, so decreased maize prices are a welcome change.

- Cheaper imports would also benefit Pakistan, which has a burgeoning chicken sector and uses more maize in processed meals.

The drawback is that domestic farmers’ margins are frequently constrained by lower worldwide prices, especially in areas where production costs are increasing as a result of increased input and fertiliser prices.

Pakistan’s Perspective:

For Pakistan, the fall in international corn rate presents both opportunities and challenges.

- Import Relief: As we all know Pakistan’s feed sector mostly relies on corn for the production of poultry and dairy products. Meanwhile it might lessen the pressures of food inflation and the overall need will also profit from lower prices.

- Farmer Concerns: If imports rise sharply it would make it more difficult to pay for growing input costs. Meanwhile this situation leads local farmers to see a decline in farm-gate prices

- Export Competitiveness: Pakistani corn export may lose appeal when world corn rates decline. Thus, it also reduces the amount of foreign cash that can be made from the product.

This delicate balance emphasises how crucial it is to coordinate procurement rules. It also guarantee that cheap imports’ advantages to indigenous farmers’ viability so they are not jeopardised.

Broader Commodity Trends:

The fall in corn futures coincides with shifting dynamics across other agricultural commodities:

- Wheat: Wheat prices have eased, partly reflecting strong global production.

- Soybean: As U.S. output forecasts failed to meet expectations, soybeans saw a little increase.

- Cotton: Declining U.S. plantings caused cotton futures to rise, suggesting a possible shortage of textile raw materials.

The interdependence of global agriculture and the necessity of varied procurement methods are reflected in these market movements for Pakistan, a nation that is closely linked to wheat and cotton in addition to maize.

Final Thoughts:

The dramatic drop in the corn rate demonstrates how regional markets may be reshaped by global supply outlooks. The food and feed sectors in Pakistan and Asia benefit temporarily from reduced pricing, while local farmers and exporters face hazards. Navigating this changing environment will need strategic procurement, encouraging government policies, and fair trade practices.

Asia, and especially Pakistan, must balance the advantages of lower imports against the viability of its own agricultural industry as the globe prepares for a record-breaking maize crop in the United States.