Introduction – Gold Rise in Pakistan:

A notable increase in gold prices in recent weeks has captured the interest of both domestic and foreign markets. Gold prices in Pakistan have risen as investors keep a careful eye on global economic indicators, especially changes in interest rates from the US Federal Reserve. Gold is now more appealing as a hedge against inflation and market volatility due to the expectation of further rate decreases.

This blog article examines the main causes of the gold boom and how they affect dealers, investors, and jewellery purchasers in Pakistan’s gold market.

Why is Gold Rising?

Investor optimism linked to anticipated interest rate reduction by the US Federal Reserve is at the core of the current gold increase. Gold rise and becomes more attractive to investors globally when interest rates decline since storing non-yielding assets like gold has a lower opportunity cost.

Recent revelations about weaker-than-expected U.S. economic figures have changed everything. Meanwhile, rumours that the Fed may drop interest rates sooner than anticipated have been stoked. This may include slow job growth and soft inflation. The global market has consequently changed. That’s why the gold price has also been rising now a days.

Global Trend Reflected in Pakistan:

This worldwide rally has caused a local gold price spike in Pakistan, where gold prices are greatly impacted by world events and the US dollar exchange rate. Early in August 2025, the domestic market price of 24K gold reached the Rs. 240,000 per tola mark, with demand rising among investors and hedgers alike.

Several local factors have amplified this movement:

PKR Depreciation

Fluctuations in the Pakistani rupee have added to gold’s appeal as a store of value, especially in times of currency instability.

Inflation Hedge

With core inflation remaining persistent in Pakistan, gold is once again being viewed as a traditional hedge, not just by institutional investors but also by households and traders.

Speculative Investment

Retail investors, anticipating further gains, are reallocating funds from volatile assets toward gold in anticipation of short- to mid-term profit.

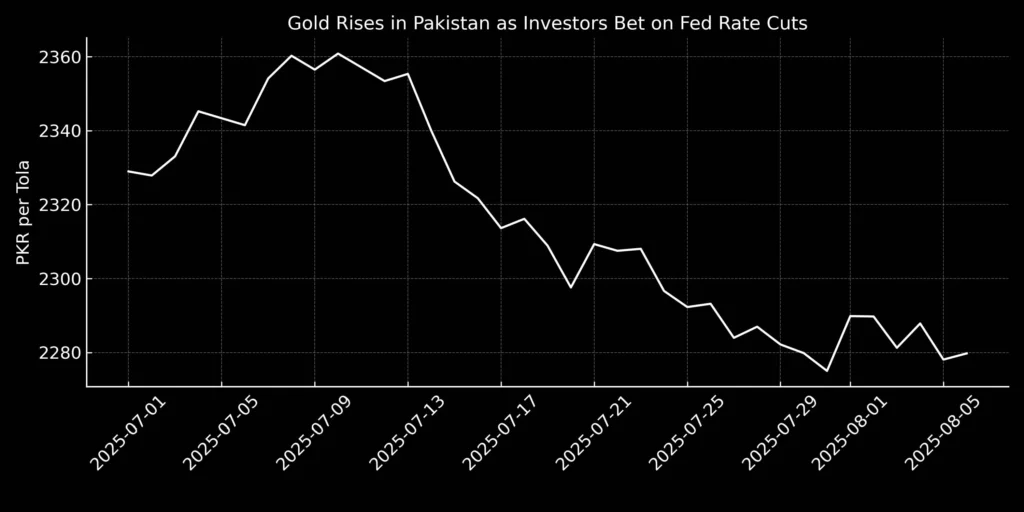

Pakistan’s Gold Prices Rise as Investors Place Bets on Fed Rate Cuts:

- July 1–August 6, 2025, simulation

- The price per tola is shown in PKR.

- designed with a sombre Bloomberg style for usage in blogs and media

- cites Zarea Market Watch as a source.

Impacts on Different Segments:

Investors

It’s assumed that gold is a comparatively safe asset class whether you are a beginner or an experienced investor. Meanwhile uncertain monetary policies and currency devaluations can make it happen. Moreover a growing number of people have been investing in gold bars, coins, and exchange-traded funds (ETFs). That’s why these investments take place on online investment platforms.

Traders and Jewellers

Jewellers are experiencing margin challenges as a result of rising input prices and declining consumer spending power, especially during the wedding season when demand usually peaks, while dealers profit from increasing demand.

Customers

The increase in gold prices has caused middle-class households to postpone purchases or choose lighter, more compact jewellery. It has, nonetheless, also prompted further questions over savings plans backed by gold.

Prospects: What’s Next?

Pakistan’s gold price trend will be influenced by a number of changing factors:

- Final decision by the Federal Reserve on interest rate cuts

- PKR-USD exchange rate stability

- Pressures from inflation and domestic liquidity

- Regional geopolitical tensions

The increase in gold prices might reach all-time highs if the Fed does proceed with rate reduction in Q4 2025 and local currency instability continues.

Zarea’s Perspective on Market Transparency:

As Pakistan’s leading B2B commodity marketplace, Zarea emphasizes price transparency and data access in the gold and precious metals market. We are committed to:

- Publishing real-time market updates on gold prices

- Enabling bulk procurement through verified suppliers

- Providing information on trends in the demand for gold in Pakistan’s largest cities

Our goal is to provide fast, reliable information to institutional and individual purchasers so they can make wise decisions in a market that is prone to volatility.

Final Thoughts:

The recent increase in gold prices in Pakistan reflects many things. Meanwhile it’s a mirror of larger economic trends taking place throughout the world. The fact is that it’s more than just a market gyration. You have to understand these dynamics in order to explore opportunities and reduce dangers. It is crucial for both consumers and investors.

Whether you’re an investor from Islamabad, a jeweller in Lahore, or a dealer in Karachi it doesn’t matter. Well updated and proactive in reaction to global cues are the secret to thriving in today’s gold market.n investor from Islamabad, a jeweller in Lahore, or a dealer in Karachi.