Introduction – Pakistan Sugar Import:

In the landscape of Pakistan’s agricultural trade, few developments draw more attention than when the country imports a commodity it previously exported. This has been the case with sugar—a staple that Pakistan has historically produced in surplus, yet occasionally finds itself importing at high cost. The story of “Pakistan sugar import after export” is not just an economic puzzle; it’s a reflection of deeper issues in planning, policy, and market coordination.

In this article, we explore why Pakistan exports sugar in some years, only to import it later—often at a loss. We also examine the underlying causes, the impact on consumers and industry, and how digital procurement platforms like Zarea are helping to improve supply chain visibility and decision-making in the commodities sector.

Understanding Pakistan’s Sugar Cycle:

Sugar is one of Pakistan’s key agro-industrial products. With more than 80 sugar mills and a sizable network of sugarcane producers, the nation frequently produces more than it needs domestically. However, during the past 20 years, there have been several sugar crises due to price manipulation, supply cycles, and policy delays.

The Paradox of Export-Import

- To take advantage of high global prices and prevent stockpiles that may drive down local prices, the government and commercial millers export sugar during years of excess.

- Later, the domestic supply falls low because of over-exports, subpar crops, or price inflation.

- In order to stabilise the market and rein in inflation, the government is thus compelled to import sugar, frequently at a higher international price.

Although this sequence is not exclusive to sugar, it has come to represent a lack of coordination between the many agro-economic players in Pakistan.

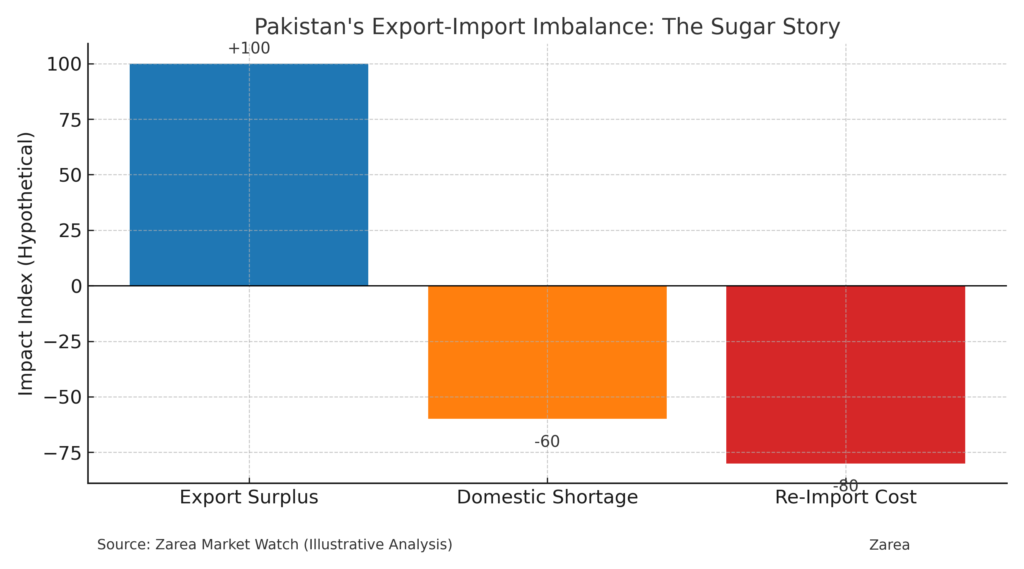

Pakistan’s Export-Import Imbalance – The Sugar Story:

🔵 Export Surplus appears beneficial (+100 index)

🟠 Domestic Shortage leads to market stress (−60 index)

🔴 Re-Import Cost worsens the balance sheet (−80 index)

After exporting sugar, why does Pakistan import it?

This recurrent pattern is caused by a number of interconnected factors:

Absence of Current Market Information

Policymakers frequently make decisions based on erroneous or out-of-date information when there is no centralised platform to monitor sugar output, stock levels, and seasonal demand.

Delayed Government Response

Decisions to allow exports are sometimes made without comprehensive analysis of domestic consumption forecasts. Similarly, import approvals arrive late, worsening shortages.

Hoarding and Market Manipulation

In order to raise prices, powerful factions in the sugar sector may purposefully cause shortages by hoarding supply, while encouraging exports during seasons of plenty.

Variability in Yield and Climate

The control of pests and water availability have an impact on sugarcane plantations. The balance may shift from surplus to shortfall if there is an abrupt decline in yield brought on by climatic occurrences.

Export Incentives and Political Pressure

Sometimes, export incentives for foreign exchange profits take precedence over long-term planning, especially prior to elections or during periods of global price surges.

Impact of Sugar Imports on the Economy:

Choosing to import sugar after exporting it has a number of negative economic repercussions.

- Foreign Exchange Drain: Pakistan imports sugar at prices that are occasionally far higher than export revenue, paying in USD.

- Price Volatility: Small firms and consumers suffer as domestic prices rise as a result of supply shortages.

- Industrial Uncertainty: Food producers who use sugar as an input must deal with cost increases and planned interruptions.

How Zarea Supports Smarter Decisions:

Current Commodity Prices

Zarea helps buyers, sellers, and regulators make educated decisions by monitoring and publishing the most recent pricing for important commodities, such as sugar.

Tools for Traders and Institutions in Procurement

By matching reputable suppliers with sugar buyers and distributors, Zarea’s platform makes the procurement process more transparent and competitive.

Predictive Analysis Using Market Information

Zarea helps to improve forecasting and planning by examining seasonal trends and commodity flows, which helps to avoid errors in export-import cycles.

Encouraging Regional Distributors

Zarea ensures more equitable market access by allowing smaller distributors and processors to compete more effectively in national procurement.

Moving Toward Sustainable Commodity Planning:

For Pakistan to avoid repeating the cycle of “export, then import”, it needs:

- An integrated national commodity monitoring system

- Stronger governance of sugar stocks

- Stakeholder transparency from millers to ministries

- And digital platforms like Zarea that bridge information gaps

Pakistan’s sugar industry will continue to be susceptible to fabricated shortages, price fluctuations, and policy blunders until these factors come into harmony, which will harm both producers and consumers.

Final Thoughts:

The story of sugar imports highlights a more significant problem with Pakistan’s trade strategy and agriculture policy. Better resource management and market stability may be achieved through digital transformation, supply chain visibility, and more intelligent procurement platforms like Zarea. Platforms like Zarea are more than simply tools as stakeholders strive for trade efficiency and food security; they are vital infrastructure for the future.

FAQ’s:

Where from Pakistan import sugar?

Pakistan imported 62,000 kg of raw cane sugar in solid form, worth $52.77K. Raw cane sugar in solid form was imported by Pakistan from the United States ($2.01K, 4,000 Kg), Malaysia ($15.95K, 32,000 Kg), China ($3.16K, 3,000 Kg), and the United Arab Emirates ($31.65K, 23,000 Kg).

Who is the largest importer of sugar?

According to statistics in 2023, Indonesia ($2.85B), the US ($2.4B), and China ($2.24B) were the leading importers. Meanwhile, Brazil ($16.2B), India ($3.97B), and Thailand ($3.81B) were the top exporters of raw sugar.

Which country uses the least sugar?

- Uganda: With only about 2 grammes of sugar used daily, Uganda has the lowest average per capita consumption.

- Myanmar: With an average daily sugar intake of about 3 grammes per person, Myanmar comes in just behind.

Who is the owner of sugar mills in Pakistan?

Perhaps the most sugar mills in Pakistan are owned by Jahangir Khan Tareen. He is the CEO and largest stakeholder of the JDW Group, which owns many sugar mills, as well as the JK Group, which also has interests in sugar manufacture.